Agility and foresight

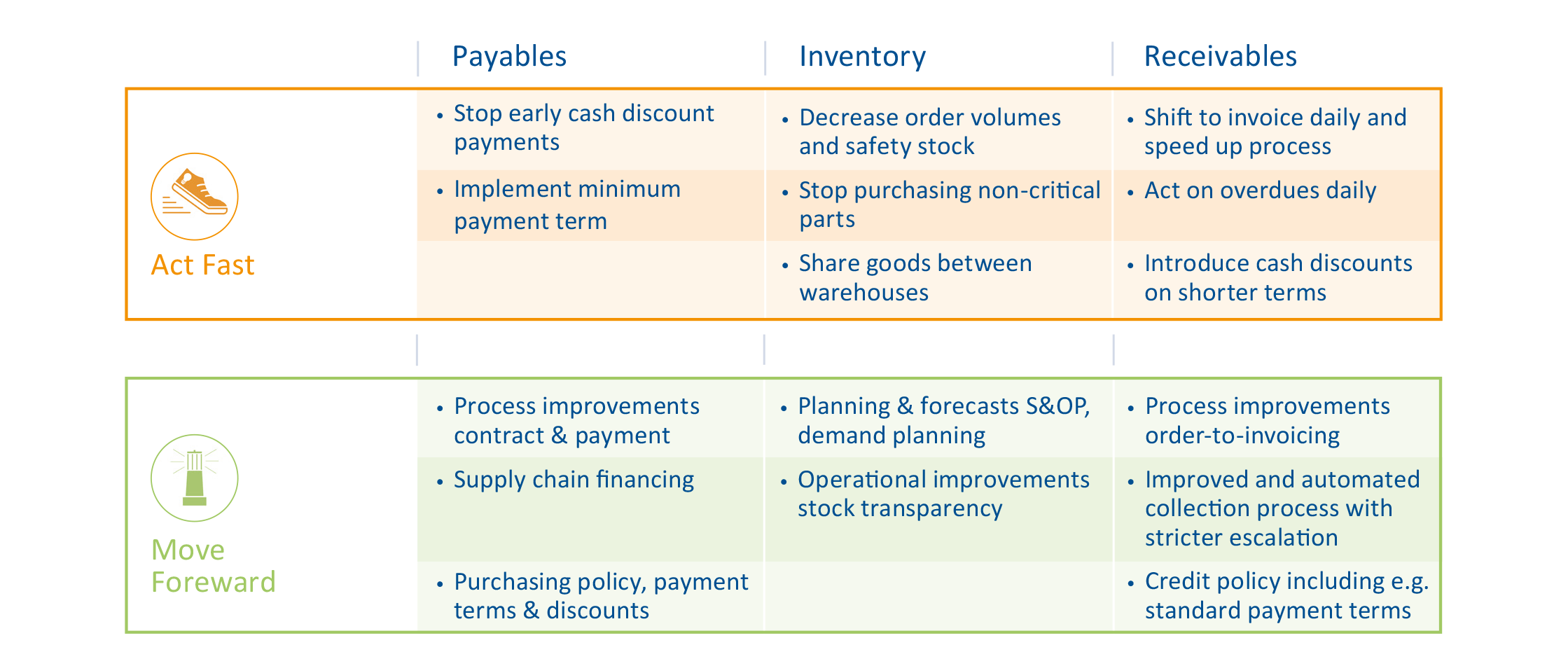

Act Fast

Set up a cash office that includes procurement, sales, and finance, as well as production management. Central to this is management control. This team prepares weekly liquidity plans and defines an alarm system. If continuous monitoring is ensured in this way, measures can be taken to safeguard liquidity in the short term.

Three simple means of securing liquidity are:

- Stop taking advantage of cash discounts and renegotiate payment terms.

- Check which inventories you can

- Stop taking advantage of cash discounts and renegotiate payment terms.

- Check which inventories you can

reduce to a minimum.

- Deliver against advance payment and react immediately when customers default on payment.

- Deliver against advance payment and react immediately when customers default on payment.

Move forward & beyond

Based on the liquidity you have secured in the short term, you should also optimize your working capital with measures that are effective in the medium and long term. In this way, you protect yourself against possible defaults and create room for maneuver in view of the volatile situation as well as for investments.

Optimization is often possible in the three areas of payables, inventories and receivables through in-depth process analysis and adjustment. If not yet in use across the board, introduce

digital solutions. Clear responsibilities help to drive forward the identification of potential improvements and their implementation. It is also important here that top management as well as the specialist departments are involved and that the task of working capital optimization is not perceived as an isolated project for the finance department.

Overview: How to optimize working capital

Our expert in securing liquidity