While UN organizations the FAO (Food and Agriculture Organization) and WFP (World Food Programme) are working with Western industrialized nations to combat the looming food crisis and provide relief packages for poorer population groups across Europe with the aim of softening the impact of inflation, procurement departments in food manufacturers and retail companies are facing the challenge of securing their supply chain and slowing down rampant price rises. Since food is not only a consumer good, but part of public service, the pressure is enormous.

The acute crisis means that parties involved in the food supply chain must balance finding solutions with scrutinizing their existing procurement strategy. The heatwave in Europe and India, and weeks of rainfall and flooding in Pakistan and the USA plus other extreme weather events clearly indicate that climate change is gathering speed around the world. That means an increase in failed harvests, which result in export bans and global evasive responses. We anticipate that the volatility responsible for the ongoing rising number of people in food poverty since 2018 will remain high. For producers, the “new normal” means getting used to recurring shortages of a range of foods.

Closer Working Relationships Between Businesses and Suppliers

To ensure that supplies are maintained in these circumstances, it is essential that businesses familiarize themselves with their own supply chain and the value creation for their most important raw materials. Businesses should work more closely than ever before with their suppliers in order to understand the relevant dependencies and risks and to jointly define early warning signals and appropriate measures.

This includes diversifying supply chains and sourcing crucial raw materials from several different parts of the world simultaneously. Potential variations in product specifications mean that procurement departments must also work closely with production and quality assurance departments. Although regionally diversified supply chains tend to be more expensive than a central supply from one single source, this option does provide greater security against supply issues in view of the increasing climate-related and geopolitical risks.

Realistic Scenario Planning

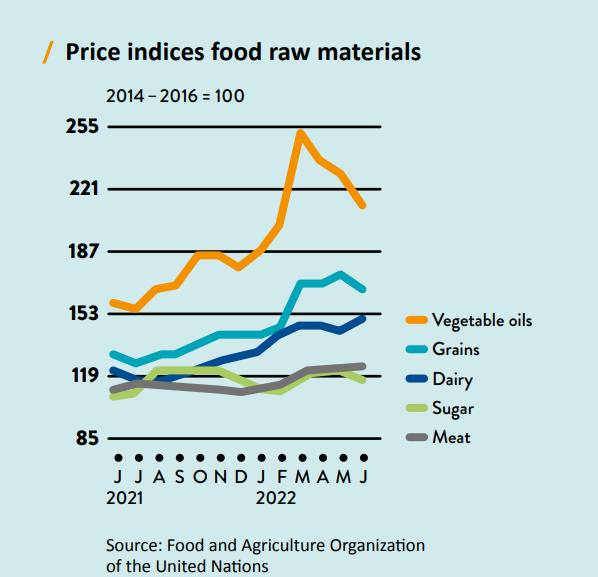

If there is one global dominant supply region for a particular product – as is the case for sunflower oil, for example – businesses should use their risk management process to define potential substitutes they can switch to if they need to act quickly. While wars obviously cannot be predicted, harvests in an arid region withering in the fields, for example, is unfortunately a realistic scenario, so should be taken into consideration when planning potential countermeasures.

The advantages of a long-term, strategic risk management process are particularly apparent in the food industry. Switching raw materials may not only affect the taste and appearance of a product for customers, but will also change production requirements and require compliance with the relevant food legislation provisions – right down to the specification, for example, that a breakfast spread must not contain rapeseed oil if the label says sunflower oil. Businesses that have considered all these issues and questions before a risk occurs will be able to respond appropriately.

Cooperation and the ability to compromise are crucial elements in finding viable solutions to the current situation. However, that does not mean buyers should simply accept price rises from their suppliers. Quite the opposite, in fact: they should challenge every price increase. Buyers should be particularly suspicious if the reason for a rise is a flat “because of inflation”; if an increase is justified, suppliers can provide evidence of what price rises have been incurred and where. Dealing fairly also means suppliers should be prepared to conduct reviews at short notice, so they can pass any price reductions on the world market on to their customers as well. Procurement departments should also tackle these increases in cooperation with the supplier. This approach might create new opportunities for offsetting looming price increases, helping to ensure that food remains affordable.