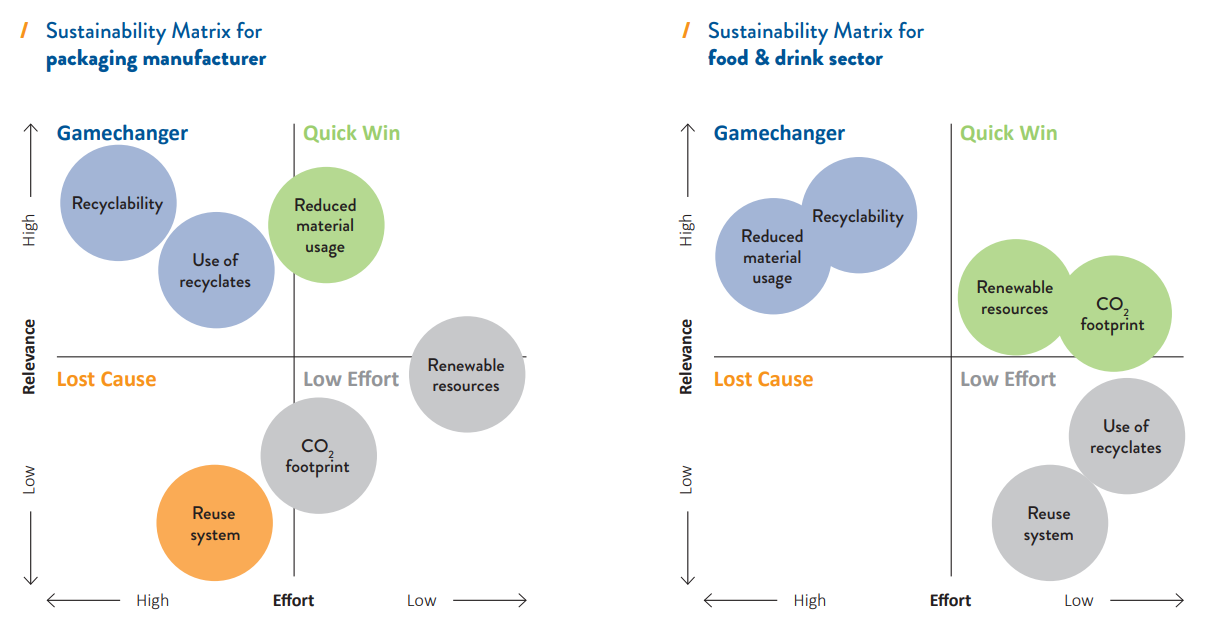

Using less material is a game changer in terms of sustainability for retail and the consumer goods sector. On the one hand it is seen as quite time-consuming, but on the other hand very much in demand from customers.

Everyone wants them, but everyone understands them differently: The criteria that packaging must meet to be considered sustainable are not precisely defined. Many different aspects play a role and do not necessarily go hand in hand: Sustainable is, for example, the use of renewable raw materials, good recyclability of the material, resource conservation in general or the reduction of the CO2 footprint.

Laws and guidelines for more sustainable packaging have been developed on the part of polistics and continue to be part of ongoing and future decision-making processes. For retail and the industry, however, it is a great challenge to orient themselves and to pursue a futureproof, strategic roadmap for the implementation of measures. Meanwhile, the demands on material properties are constantly increasing: For example, the Packaging Act has set recycling quotas that can only be achieved through better recyclable packaging. At the European level, the Green Deal has set the targets for sustainable packaging. Levies such as the “plastic tax,” whose assessment basis is the amount of non-recycled plastic waste, are about to be implemented.

At the same time, there is increasing pressure from consumers and retailers to drive innovation and offer more sustainable packaging solutions. Packaging manufacturers, consumer goods producers and

strongly in the coming years and will be a decisive competitive factor in the future.

It is interesting to note that companies perceive a discrepancy between what consumers regard as sustainable and what science and politics define as such. They are therefore facing major challenges in developing and implementing sustainable packaging solutions, as they try to meet both the sustainability expected by consumers and the sustainability defined by science and politics.

Let’s dive into how to develop a strategy for sustainable packaging.

Many relevant consumer goods manufacturers and retailers act only because of the moral pressure exerted by consumers. A credible and sustainable strategy to implement the topic authentically is often missing.

Paul Mohr, Managing Director

Recommendations for Action

Implementing sustainable packaging solutions regularly poses new challenges for businesses. As demand for sustainable packaging will grow significantly over the next few years, companies will continue to find it complex and challenging. Social developments, such as the rising number of single member households and the trend for convenience as well as the boom in e-commerce, not least because of the Covid-19 pandemic, all put an even greater focus on the subject of packaging and packaging waste. Therefore, it is all the more important for all companies to analyze what potential there is for them in terms of sustainability and sustainable packaging and what solutions are worthwhile for their own business. Sustainability does not necessarily need to result in additional costs if the issue is looked at in full and for the long term, and if strategic procurement is involved in the procurement of resources at an early stage.

Creating Transparency and Calculating Maturity Level

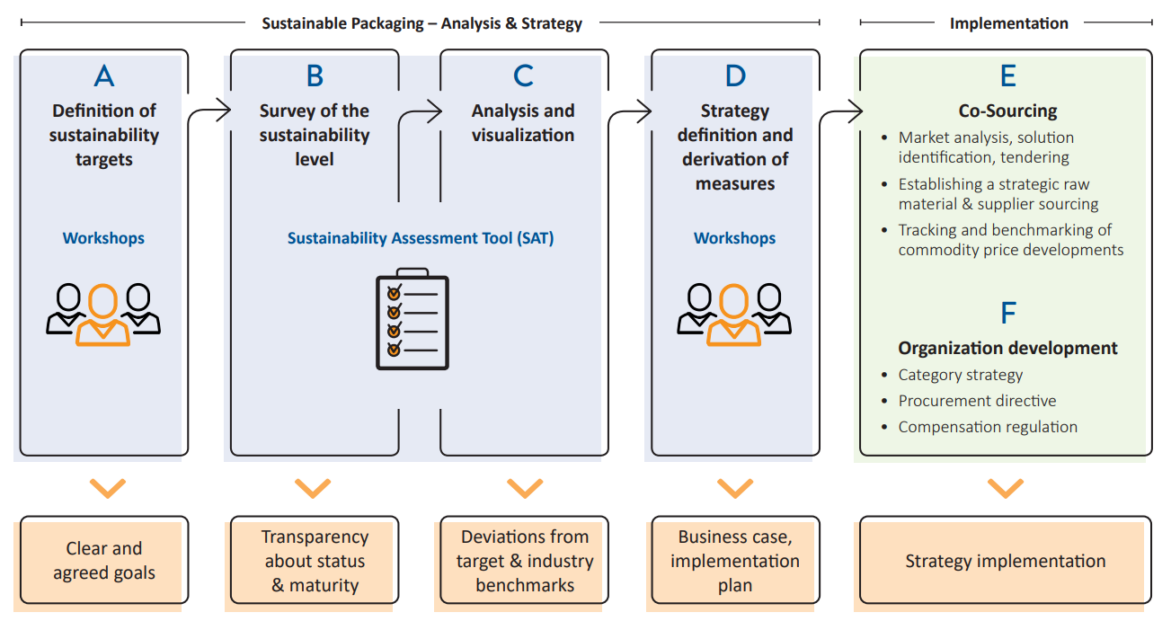

A holistic appraisal and analysis forms this basis: how is a company currently positioned in terms of sustainability – also in comparison to the competition – and what are its aims?

To calculate the maturity level, it is essential to define a list of criteria that reflect every aspect of sustainability as comprehensively as possible. It is crucial to define the criteria in a quantifiable way.

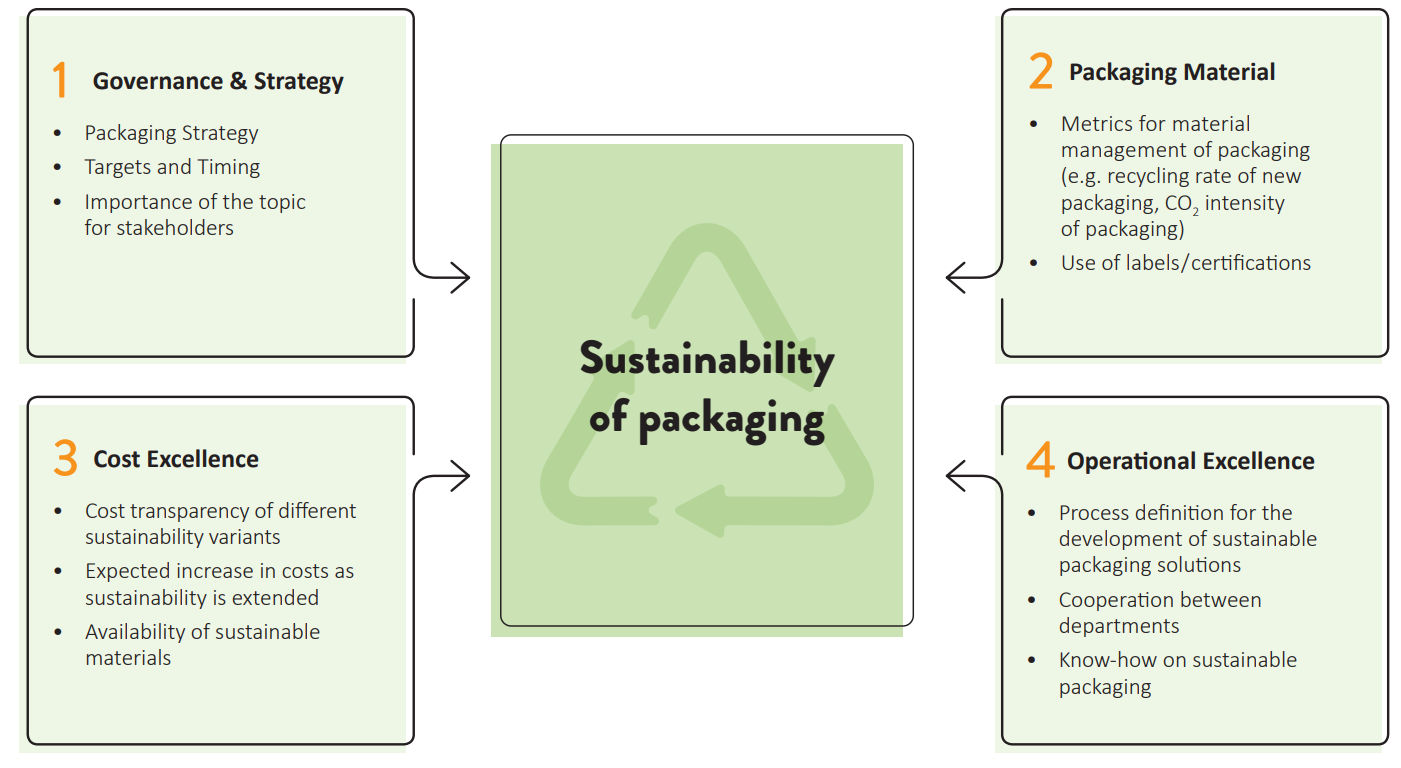

With the aid of this list, a company should eventually be able to create transparency across four dimensions: governance & strategy, packaging materials, cost excellence and operational excellence.

In each of these areas, a comparison needs to be made between the company’s sustainability status quo – where you are at the moment – with the goal being aimed for – and where you want to be – so that the gaps can be identified.

INVERTO Model for Assessing Packaging Sustainability

1 Governance & Strategy

Is sustainability incorporated in the business strategy, and to what extent? Defining a company’s individual target vision is essential for developing a clear strategy and guiding principles that can always be adhered to.

Governance covers all the issues that a business needs to address for achieving its sustainability goals and the measures linked with them. This includes, among other things, setting a timescale for when you would like to reach your sustainable packaging goals. Setting a budget for implementing your sustainability strategy also comes under governance.

As a basic rule, the defined sustainability strategy needs to consider interests and influences both internally across all departments and externally from customers, trading partners, legislation etc.

2 Packaging Material

Firms also need to ask themselves which packaging solutions support their business strategy and what measures can ultimately be used to manage sustainable packaging – for example how much recycled content is in the new packaging, or what its CO2 intensity is.

The use of a sustainability matrix is useful for evaluating sustainability approaches in general at a product level. It compares the effort the implementation processes will take the company to the actual relevance for the market or customer. Depending on the particular perspective – the packaging manufacturer versus the food and drink sector – possible approaches for sustainable packaging solutions will be regarded and evaluated differently.

In food retail, shelf life and product quality assurance are the top priorities. Another factor is making the product as easy and convenient for the customer to use and handle as possible. The use of recycled materials is therefore only possible to a certain extent.

Using less material is a game changer in terms of sustainability for retail and the consumer goods sector. On the one hand it is seen as quite time-consuming, but on the other hand very much in demand from customers.

3 Cost Excellence

How well is the company placed to manage its procurement overall? What costs would potential sustainable packaging strategies bring about in the business? What pricing strategy can and should be adopted for the end product?

To be able to answer these questions, firms must achieve transparency about additional costs. In concrete terms, this means performing a Total Cost of Ownership (TCO) calculation for the conversion of production and the changeover to new materials.

Aspects that need to be considered include: general additional costs, which could result with the production and enterprise transision, the

time needed for production testing and product testing, impact on the packaging’s functionality, throughput speeds, resource availability in

general and the potential impact on machinery.

Once transparency is achieved, you can move on to look at the classic approaches to optimizing procurement costs, which also apply to sustainable packaging:

• Strategic procurement – in other words, regularly benchmarking market prices and renegotiating where necessary,

• Reducing packaging volumes overall or replacing with more efficient materials,

• Standardizing materials and using them for several products to reach synergies or procurement volumes and to reduce the time you need to spend sourcing.

-

Examples from INVERTO’s project experience

show that switching to sustainable packaging solutions can also bring cost benefits:By changing its packaging from a can – made out of a combination of plastic, aluminum and cardboard – to purely cardboard packaging, one food company managed not only to produce more sustainable and completely recyclable packaging, but also to make savings amounting to 8 percent. The packaging, by changing from composite material to 100% cardboard, also made licensing cheaper.

Using GT1 recycled cardboard instead of GC2 virgin fiber-based board for snack boxes meant that a company in the foodservice industry could make savings amounting to 25 percent.

4 Operational Excellence

Every step of implementation must be planned consistently, meticulously and sustainably to prevent the organization as a whole from becoming overburdened. It is essential for all internal stakeholders to work together: departments such as logistics, marketing, procurement, production and management. Only through this kind of teamwork will it be possible to reach goals agreed across all departments, and to eventually set up a process for packaging development that incorporates the most diverse aspects of sustainability and also cost perspectives.

When it comes to knowledge about sustainability issues, many companies have some catching up to do, as the latest study shows. It is important to achieve continuous transparency about the market situation and sustainable packaging solutions.

Additionally, an internal quality control authority needs to be established to test new packaging for relevant sustainability issues and to ensure that defined internal guidelines comply. In procurement, it is a good idea to establish strategic sourcing of raw materials and suppliers, with a focus on sustainability issues. Procurement and raw material price changes must be recorded and regularly benchmarked. To ensure sufficient access to sustainable materials, it is vital to systematically build up and develop a sustainable supplier pool. These

challenges can often only be met if companies create extra procurement resources.

Conclusion

The one single sustainable packaging that is the best solution for every product and every company simply does not exist. Many factors need to be considered: legal requirements, scientific findings, customer demands, limited resources, technical feasibility and costs, as well as differing sustainability goals which unfortunately may not go hand in hand and which sometimes contradict each other. Using renewable raw materials, for example, does not necessarily make packaging sustainable if it has been produced abroad and transported halfway round the world.

Even with all its challenges, sustainable packaging is a relevant subject that will become increasingly significant in the future. The time has now come for companies to act in terms of sustainability as legal requirements in Europe are becoming more stringent. Precise recycling goals for packaging waste and strict regulations for Europe-wide compliance were defined in the “Green Deal”: by 2030, 70% of all packaging and 55% of all plastics must be recyclable. There are also plans to introduce a minimum recycled content in packaging. The ruling includes further measures to tackle superfluous packaging as well as an action plan for circular economy with a particular focus on resource intensive sectors.

Companies should take independent advice and determine which sustainability criteria are most important to them. The starting point is a holistic analysis of company‘s current sustainability maturity level and of goals for the future. Once a sustainability strategy has been decided, the next step is to implement it consistently within the organization. This will enhance the credibility, strengthen a company‘s ability to compete and ensure the return on investment.

INVERTO Offering “Sustainable Packaging”