The Covid pandemic has had a massive impact on raw material prices and availability. It is likely that we won’t return to pre-pandemic trends: far-reaching changes such as a demand for climate-friendly economic activity or supply chain re-regionalization are emerging, and they will leave their mark on international raw material market price structures. Companies should use digital solutions now available to arm themselves against price and supply risks, with as much transparency as possible.

Raw Material Study How Much Longer?

This year’s Raw Materials Study shows the current dynamics in the raw material markets very clearly: it is dominated by concerns about business results and demand fulfillment. It’s hard to beat the world market, but by using intelligent tools, companies can meet the challenges of price increases and material shortages.

The drastic price rises in nearly every raw material category seem to have taken many companies by surprise. Following the economic downturn caused by the pandemic, most economic experts were expecting there to be a longer crisis and persistently low prices. But global consumption recovered faster and more strongly than expected, with the result that after months of factory closures in many parts of the world and ongoing supply chain turbulence, there are simply not enough materials to meet every requirement.

Aluminum, iron and steel, as well as plastics, have become significantly more expensive. Almost half the study participants worry that the price rally isn’t over yet. And 40 percent of those surveyed also expect the same issues when it comes to paper, wood and cellulose products. Most of the participants, however, do not fear any real supply bottlenecks. Wood and paper (29 percent) and plastics (27 percent) were mentioned most frequently.

Unpredictable Situation

The developments of oil, gas, and coal show how unpredictable the situation actually is at the moment: when we surveyed them in June, only around a quarter of respondents expected cost increases. However, electricity and fuel prices exploded after the summer break, and there are even fears of blackouts over the winter. Some exceptional factors are responsible for this: the Organization of Petroleum Exporting Countries (OPEC), for example, insisted on restricting oil production for a long time. Due to the weather, there was a lack of solar and wind energy, which resulted in more gas and coal being used for electricity production.

High fossil fuel prices, in turn, led to several companies in Europe and China halting production because it was simply unprofitable. This could all result in real shortages. In the case of aluminum, for example, this is already becoming apparent.

Transparency More Important Than Ever

In view of such great uncertainties, it’s no longer enough to simply talk to your direct suppliers about the current situation. Transparency about raw material markets is imperative along the entire supply chain, if you want to be able to make the right decisions.The basis for this is the establishing of a professional risk management system that collects all the relevant information with the help of digital tools and

- Price indices

- Production of raw materials and auxiliary products

- Developments in the countries producing them

- Monitoring of delivery routes

The choice of the right digital solutions depends on your specific information requirements and the digital infrastructure already in place in your company.

Monitor Auxiliary Products Too

Aluminum, as an example, shows how important it is to keep an eye on the production of auxiliary materials when it comes to raw materials: in mid-October, an urgent announcement from the German Metals Association caused a scare among many companies with the warning that aluminum stocks in Europe could soon run out, as China had largely stopped producing magnesium, an essential component in aluminum alloys. Since China is currently a quasi-monopoly with a share of 87 percent of global magnesium production, other sources cannot compensate for the shortfall.

Establish Fair Prices

Software can also help to establish prices for primary products with a high proportion of raw materials fairly and transparently within a should-costing framework. Using this method, you can establish what proportion of your total price comes from raw material prices. Using this as a basis, you can introduce an index-based price escalation clause and adjust it regularly. Your suppliers then receive appropriate compensation for their share of the added value, while the buyer can rest assured that they won’t pay too much when raw material prices go down. It’s a win-win situation for all parties concerned.

Almost two thirds (64 percent) of the respondents in our study have already concluded contracts with price escalation clauses, and 28 percent have agreed to predefined surcharges in price agreements with their suppliers. However, hardly any companies are able to implement these two concepts for all their raw material requirements; 41 percent of the participants also buy on the spot market, so they have no fixed prices at all. In the current situation, this is unquestionably risky, especially as more than half are worried they will only be able to pass on a fraction of their price increases to their own customers.

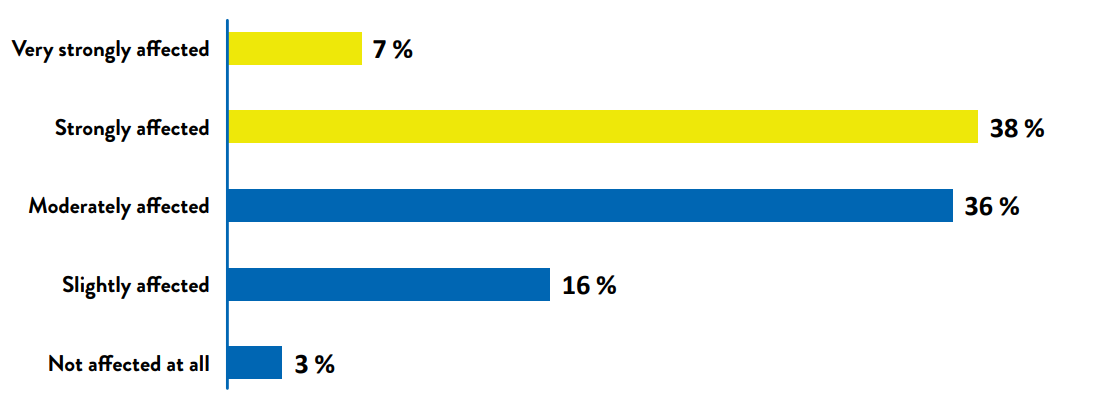

„To what extent was/is your company’s raw material supply affected by the Covid-19 pandemic?

With things as they are now, suppliers are hardly going to want to agree on agreements with fixed prices. Although 54 percent still use these fixed-price contracts, more than 80 percent of study participants said that the duration of this type of contract has reduced significantly in some cases.

Find the Right Time to Buy

Many raw materials are subject to seasonal fluctuations. This is mainly true of agricultural products, where the price usually follows the harvest cycle. Artificial intelligence can help determine the optimal time to buy by evaluating data sets from the past as well as current information, for example about harvest quality and quantity or how consumer requirements are developing. With the current volatile developments as we work towards the “new normal”, it makes particular sense not to rely solely on data from the past.

// Preview | Table of contents & text extract

Study Design

Almost 100 procurement managers and managing directors, mostly from German-speaking countries and Great Britain, took part in this year’s raw materials study. 49 percent of them come from the manufacturing sector, 16 percent from mechanical engineering and 11 percent from the automotive industry.