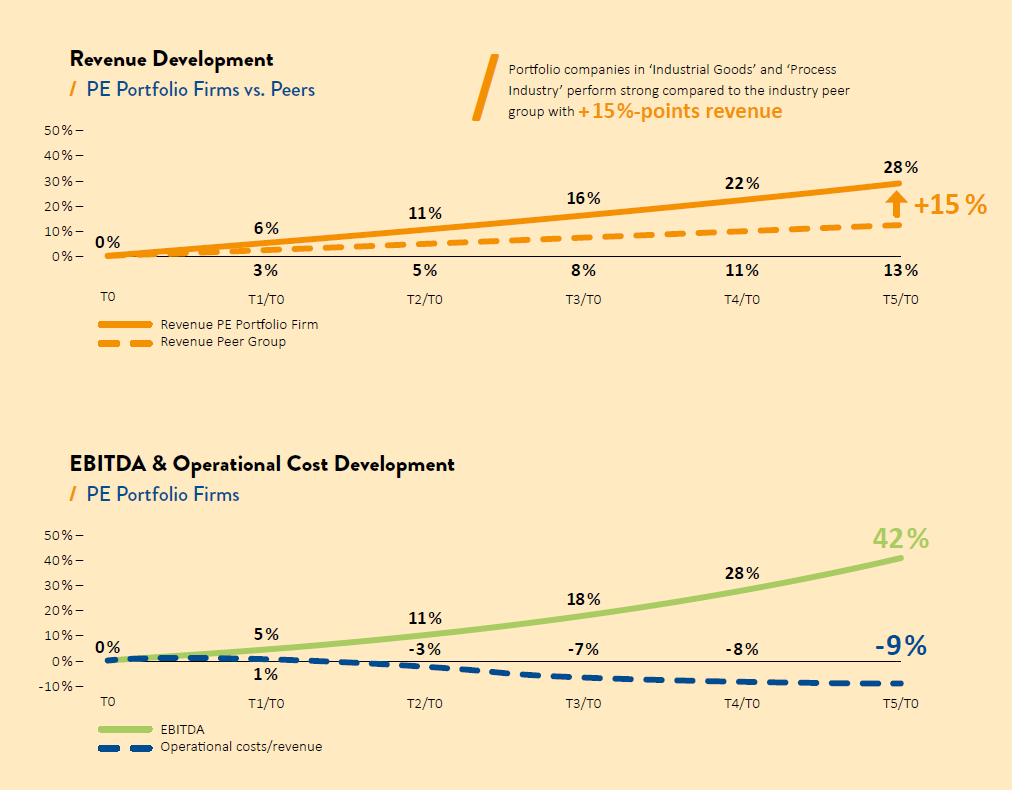

The disproportionate growth in EBITDA relative to revenue identified at portfolio companies – 42 versus 28 percent – demonstrates that gains are being achieved not only through accelerated revenue growth, but also through improved cost efficiency. In contrast, profitability in companies without a private equity stake falls as sales rise: while the rise in sales is 13%, the growth in EBITDA is just 9%.

A closer look at costs reveals that private equity firms start optimizing costs soon after they acquire a company. The focus here is specifically on other operating expenses, relating to indirect demands such as facility management, IT and marketing expenditure, and so on. A significant reduction in other operating expenses is already visible from the second year (T2) after the acquisition of a portfolio company. Within five years, other operating expenses fall by an average of nine percent. This optimization is a significant factor in the disproportionate growth in EBITDA.