Risk Management

Firefighting instead of Investing in Fire Prevention…

…that sums up the results of our latest risk management study. Nine out of ten respondents were affected by delivery failures in the past year. But despite this, the number of companies investing in strategic risk management and corresponding digital solutions actually stagnated.

In light of the turbulence in nearly every supply market, we had expected companies to further develop their digitally-supported risk management systems. However, the number of companies that use structured risk management software has remained almost unchanged in comparison to the previous year. Almost 90% of participants expected risk management to become more relevant in procurement in the future. Clearly, lots of procurement departments were so busy ensuring the supply of key goods that there was no time left to think about strategy and development.

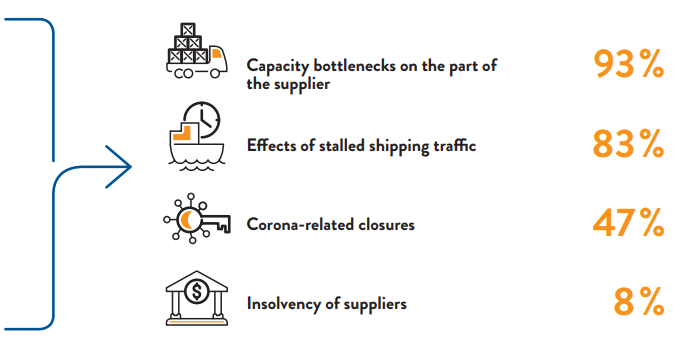

90% of those who participated in the study reported delivery failures within the past six months. The main reasons given were capacity issues for suppliers (93%) or bottlenecks in logistics (83%). Factory closures due to the pandemic were a factor for almost half of the respondents.

Almost no one expected the situation to improve any time soon. On the contrary, 93% anticipated supply risks to remain the biggest threat to their company in 2022. In second and third place were price risks at 78% and increasing energy costs at 63%. The number who saw price risks as a threat had increased by 46%: more than double compared to the previous year. There’s no doubt the worry lines on the decision-makers’ foreheads have become even deeper in the meantime, given that at the time of the survey, the war in Ukraine was still unimaginable.

In the face of these challenges, most other aspects of risk management have slipped into the background. Less than 20% saw risks relating to quality, sustainability or compliance as a real threat. 39% of respondents expressed concern that individual suppliers’ failures could be a problem for their own business – that’s 17% less than last year.

Clearly, many companies have diversified their sources to ensure they have a reliable supply. According to our study, almost 80% of participants now work consistently with at least two suppliers. However, the risk seems to weigh heavily on companies with concerns about the stability of individual suppliers, as the number who actively support suppliers has almost doubled from 11% to 21%.

The majority of buyers are turning to proven methods to secure a reliable supply: they are negotiating long-term framework contracts and increasing inventory levels – the latter saw a rise of 17% compared to last year. Having larger safety stocks is an understandable and rapid response to potential shortages, but this is expensive as a long-term solution, because it ties up capital, and also has the potential to distort the market. If lots of buyers order more than they actually need, just to fill their warehouses, it creates an artificial shortage that then results in increased prices. Accurate forecasting combined with agreed order commitments with suppliers is the best solution here.

When putting dual or multiple sourcing strategies into practice, nearshoring is playing an increasingly important role, as we are seeing in our own projects. This even applies to product groups where it seemed unlikely before the pandemic, such as electronic components. The growing shift towards procurement in Europe may be a result of the Supply Chain Act, but companies are also increasingly taking total cost of ownership into consideration. Suppliers in Eastern Europe or Turkey, for example, often produce more flexibly than Asian providers, accept smaller purchase volumes, and the delivery routes are considerably shorter. These benefits can offset higher unit prices because, for example, there is less residual stock or because unexpectedly high demand can be fulfilled more quickly. Whether the war in Ukraine will curtail the trend for nearshoring cannot yet be reliably ascertained.

The German Supply Chain Act, which aims to ensure that UN sustainability rules are applied in the supply chain, is an issue for around half of the respondents (44%). The majority of them are currently putting specific measures in place. These include, for example, direct discussions with suppliers, incorporating standards into their own risk management, and defining measures to take in the event of non-compliance.

33% of study participants said the Supply Chain Act does not affect them. However, we also advise anyone not yet affected by the regulations to think ahead, as customers who have to apply the new rules will also expect their suppliers to comply. The European Union has also now presented a bill that aims to protect environmental standards and human rights in the supply chain. As was widely expected, this is much stricter than the German law and will affect a much greater number of companies.

In terms of sustainability risks, reducing their own carbon footprint is the most important issue (70%) for the companies surveyed, followed by environmental damage caused by production methods (51%), and compliance with workers’ rights (42%). Transparency in the supply chain is the key requirement for countering these risks. This involves integrating sustainability risks into supplier evaluations and defining appropriate measures. The evaluation of suppliers and product groups should be incorporated into a company’s procurement strategy, as well as its risk management.

The war in Ukraine will only further exacerbate existing supply and price risks. In the short term, if supply issues occur, companies need to prioritize the products with the highest margin. It could be that production has to be stopped in individual cases, if costs can no longer be covered and it is unrealistic to pass them on elsewhere.

In light of the drastic increases in raw material and energy prices, it is now virtually impossible to avoid price rises. That said, buyers should still try to balance out these cost increases. Price demands should be questioned; cost breakdowns and should costing are effective strategies for understanding price composition – and also for recognizing whether, and to what extent, a price increase is justified. Design-to-cost measures and material substitutions can be an effective means of counteracting cost increases.

Despite all the anger about the cost spiral, negotiators should be concerned about a fair balance: Passing on massively increased costs to the supplier alone is certainly not the method of choice in the current instability of supply chains. It makes more sense to coordinate closely with the sales department in order not only to accept unavoidable cost increases, but also to pass them on to the company’s own clients.