Sooner or later, price increases catch up with every company.

Inflation

The world in black and grey

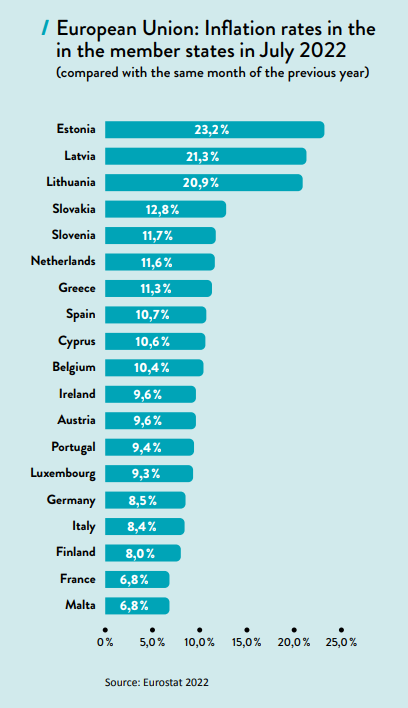

Ten percent has always been possible – anyone who started out in procurement learnt that in their first few weeks on the job. It has mostly been like this for the last 50 years. But with inflation starting last year, and currently ranging in the European Union and the United Kingdom from 6.5% (France) to 25.2% (Estonia), the old mantra of cost reduction by ten percent per year is no longer achievable. Procurement departments need new strategies.

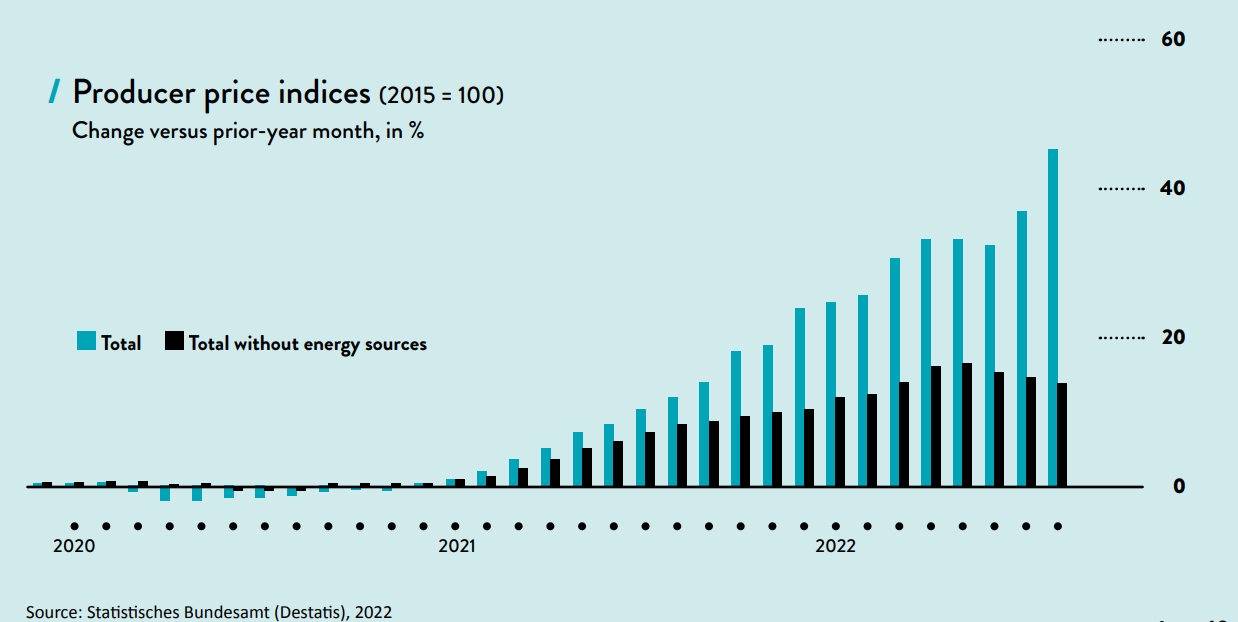

According to Eurostat, producer prices rose by 37.8% across the EU in July. Analysis by the Cologne Institute for Economic Research found that2022 will “far exceed the cost shocks of the mid-1970s, early 1980s and immediately before the global financial crisis” – even if the increase does not pick up speed from now on.

The current squeeze on costs arises from a series of overlapping developments: the pandemic with outbreaks recurring around the world has caused repeated lockdowns, halts to production, and logistics bottlenecks. The Ukraine war has led to shortages of gas, crude oil and raw materials for industry on the one hand, and wheat and cooking oils on the other (see our report “Everyone Should Be Fed” page xx). The massive increase in investment in digitization and electrification has led to a semiconductor crisis that has not yet been resolved, even though manufacturers are now making large investments and building new plants, and inflation is leading to consumer reticence, especially when it comes to electronic items.

Geopolitical conflicts, particularly between the USA and China, have led to a decrease in global economic ties, even before 2020. But it was only Covid that made us aware of the true vulnerability of global supply chains, which were previously thought to be so stable. Inevitably, the problems caused by the pandemic, wars, digital innovation and punitive tariffs have led to shortages in the market and price rises. In an analysis by Citigroup, for example, the additional costs for raw materials alone this year are estimated to be five to six trillion dollars – that’s almost six percent of global gross domestic product.

Sooner or later, price increases catch up with every company.

Sooner or later, price increases will catch up with every company. As they are driven by supply, we do not anticipate weaker demand slowing down price increases quickly. Instead, we expect higher prices to be passed down the supply chain and eventually reach consumers. The Herculean task facing procurement departments in all sectors is to drive back inflationary pressure as much as possible.

This means that buyers are finding themselves in a situation that hardly anyone in work today has experienced. After all, it’s almost 50 years since the oil price shocks, and the manufacturer price rises before the 2008 financial crisis were innocuous in comparison with today’s developments.

Decision makers and team leaders should be aware of this and not just measure their employees against historical savings targets or the other normal performance parameters previously used. These are simply not achievable under current conditions. Instead, they have to be adapted, and meaningfully supplemented by other relevant measurement variables.

Part of the new role of procurement teams is understanding that the relationship between them and their contacts has been reversed: whereas in the past it was buyers who made the demands, today, in many areas, it is the suppliers. It is therefore worth preparing even more intensively for negotiations and investing in partnerships where appropriate.

For example, anyone who knows the exact composition of a product and each of its cost drivers, will find that not every increase is justified. In situations like that, companies have the opportunity to fend off price increases, at least to an extent. As well as a new role, this also shows a new rationale for procurement: every cent of additional costs that employees can avoid is a contribution to containing the general upward trend in prices.

When cost increases have been made objectively, success currently means being able to agree on a fair distribution of the additional costs. Fairness to suppliers includes open dialog. Beyond discussions about prices and costs, find out what challenges and constraints your key suppliers are facing. Analyze the upstream supply chain together, look for mutual opportunities for improvement. Discuss alternatives to critical primary products – both sides can benefit here from the respective technical expertise of the other.

It is clear that it is a challenge to manage the effects of the pandemic and the war on supply chains at the same time – but experts have repeatedly warned that climate change is an even bigger task. Weather phenomena such as droughts, heavy rains, hurricanes, and heatwaves have been increasing worldwide. They not only affect agriculture, but also increasingly all other branches of the economy by damaging infrastructure. Diversification and, where possible, regionalization of supply chains are essential strategies to protect against geopolitical and climate risks. Unilateral dependence on suppliers or supply regions should be a thing of the past.

Companies must put their risk management to the test and look at possible scenarios. It is important to keep a balance: in science, “black swans” are referred to, to mean events that are unlikely to occur. Protecting yourself against all “black swans” is not productive. But as well as unrealistic scenarios there are those that are more likely to occur. We call these “gray rhinos in the mist”. These risks are vaguely recognizable. They could become a real threat to your company. You must plan countermeasures against these risks. And just as infrared cameras help to recognize living beings in the fog or darkness, so digital solutions help to validate risk management with data, and draw the right conclusions from it.