The most suitable goods for shipping by train are high-value ones that take up little space.

Train travel between China and Europe along the New Silk Road continues to grow unabated. In 2018, more than 370,000 containers were carried on the route between east and west. With the train being substantially quicker than the cargo ship, the overland route offers faster lead times and a significantly lower capital tie-up: yet another building block in working capital optimization.

Road and Belt Initiative does not refer just to a single railway line, but to an entire network of connections to northern China via Russia or Mongolia, as well as another route to central China via Kazakhstan, Russia, and Belarus. Destinations in Europe also include London, Madrid, Stockholm, and Hamburg.

/ What is more important to you – low cost or short lead times?

Trading consumer goods for construction materials

The most common items exported to Europe are textiles and consumer goods, such as domestic appliances. Then for the return journey, containers are typically loaded with primary products for the mechanical engineering and automotive industries. It is no secret that VW, Audi, and BMW send components to their Chinese sites by rail.

Depending on the origin and destination, train journeys take between 11 and 20 days, making them much quicker than cargo ships, which take a good month to arrive. Only air travel is faster, but also 80% more expensive than surface-based modes of transport. The cost of rail versus sea travel, however, cannot be compared so easily. The online calculator of the Eurasian Railway Alliance Index, ERAI (www.index1520.com) – a consortium of the Kazakh, Russian, and Belarusian state railways – does provide some indication, though this does not replace a binding offer. The number 1520 in the URL refers to the former Soviet broad gauge.

Cost savings over lead times

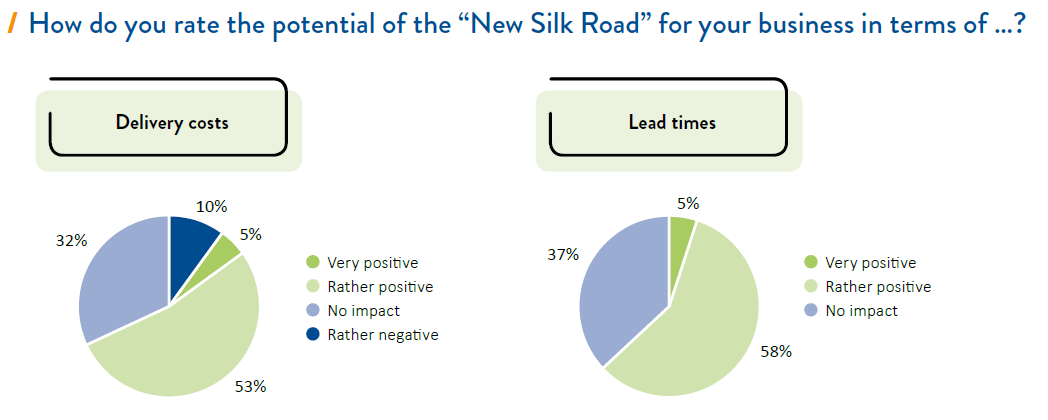

We asked around 40 experts about how much companies in German-speaking countries use or would like to use the New Silk Road, and what their priorities are in the supply chain. 58% of respondents said that cost is the most important factor when choosing a method of transport. 32% said their focus was lead times.

The faster travel time by rail not only means a faster time-to-market, which is critical for fashion companies, but it also reduces the amount of capital tied up in two ways. Firstly, the goods arrive, then are processed, and are sold faster. Secondly, stock levels can be reduced because the frequency of deliveries can be increased. These factors have a significant impact on working capital, and therefore must absolutely be taken into account when deciding on the means of transport. The ERAI index calculator, mentioned above, also helps with the pricing.

Less capital tied up thanks to improved timing

The faster travel time by rail not only means a faster time-to-market, which is critical for fashion companies, but it also reduces the amount of capital tied up in two ways. Firstly, the goods arrive, then are processed, and are sold faster. Secondly, stock levels can be reduced because the frequency of deliveries can be increased. These factors have a significant impact on working capital, and therefore must absolutely be taken into account when deciding on the means of transport. The ERAI index calculator, mentioned above, also helps with the pricing.

Our study found that the number of businesses fearing delivery shortages was around three times higher among companies with a turnover of less than €1 bn than in companies with a greater turnover (36% vs. 13%). 55% of SMEs are concerned about delivery delays, compared with only 25% of larger companies. This is another argument in favor of the land route, which is considered to be reliable and on schedule. Trains only have narrow time windows available to clear customs at the Chinese and Polish borders, which must be strictly adhered to.

Environmental aspects were a major consideration for at least 27% of respondents, since rail transport uses the least amount of CO2 compared with other cargo transport methods. With pressure from consumers to improve sustainability in business practices on the rise, environmental protection will only become a higher priority in the future.

Are some goods more suitable than others?

Rail transport is not suitable for all types of goods. The route passes through different climate zones and altitudes. It is also not electrified along the entire distance, so there is no guarantee that refrigerated wagons will operate consistently. This means sensitive products such as medication or food cannot be carried, and dangerous goods are completely prohibited.

The most suitable goods for shipping by train are high-value ones that take up little space. The higher the value per kg, the more the cost of the train journey becomes comparable with sea travel. This applies even more so if the time that capital is tied up for is considered.

However, train prices are expected to increase. In recent years, the Chinese government has subsidized the rail line to make it competitive. These subsidies, which were initially 50%, are now being gradually reduced, and are set at just 30% this year.

In recent weeks, Covid-19 has not only disrupted the supply chains. Ships cannot be loaded and dispatched as usual. The train can be a solution due to faster reaction times and greater flexibility. Although the station in the most severely affected Chinese city of Wuhan is still uncoupled, the rail network is otherwise in operation.

Opportunities for market extension and new suppliers

The New Silk Road brings markets that have so far received little attention within easy reach, especially countries along the route such as Mongolia and Kazakhstan. Companies seeking to qualify new suppliers in these areas should define suitable product groups and carry out targeted searches. However, nothing is possible without professional risk management, since there have been no stable trade relationships with these markets to date. Equally, existing regulations could become stricter, and lead to price increases or delivery delays. It is sensible to build up supplier relationships cautiously with partners in these countries, and undoubtedly to maintain existing ties with reliable suppliers.

We expect the New Silk Road overland connection to be used even more in the future. The corona epidemic could prove to be a catalyst here. The rail line will become a middle ground between fast but expensive transport by plane and the cheap but slow way by ship. As connections are extended, and a southern route through Pakistan, Afghanistan, Iran, and Turkey becomes available in the future, there is an opportunity to connect even more markets to international trade flows. Companies in Europe should now assess the rewards they can reap, but without losing sight of the risks.

By subscribing to our newsletter, you will receive the current issue of our customer magazine Supply Management Insights three times a year: