Traditional procurement approaches are no longer sufficient in today’s automotive industry. The rise of Software Defined Vehicles (SDVs) is revolutionizing the sector, merging automotive engineering with advanced technology and redefining the procurement landscape. Software licenses already make up 5–10% of the vehicle BOM — and the share is even higher when factoring in specialized embedded software, which is often procured separately. This transformation demands specialized expertise in software procurement to ensure seamless integration, adherence to rigorous safety standards, and sustained competitive positioning.

The shift to SDVs introduces significant challenges, including the complexity of integrating advanced software systems, navigating evolving industry regulations, and adapting to rapid technological advancements. As automakers increasingly partner with non-traditional suppliers, procurement teams face the added complexity of aligning on quality, innovation, and compliance with suppliers outside the traditional automotive sphere. Addressing these challenges is critical for organizations aiming to thrive in this new era.

The Era of Software Defined Vehicles and Software Driven Sales

SDVs are rapidly gaining momentum, driving the automotive software and electronics market to grow from $320 billion to $1.2 trillion by 2035, with suppliers poised to capture approximately $700bn of this expansion*.

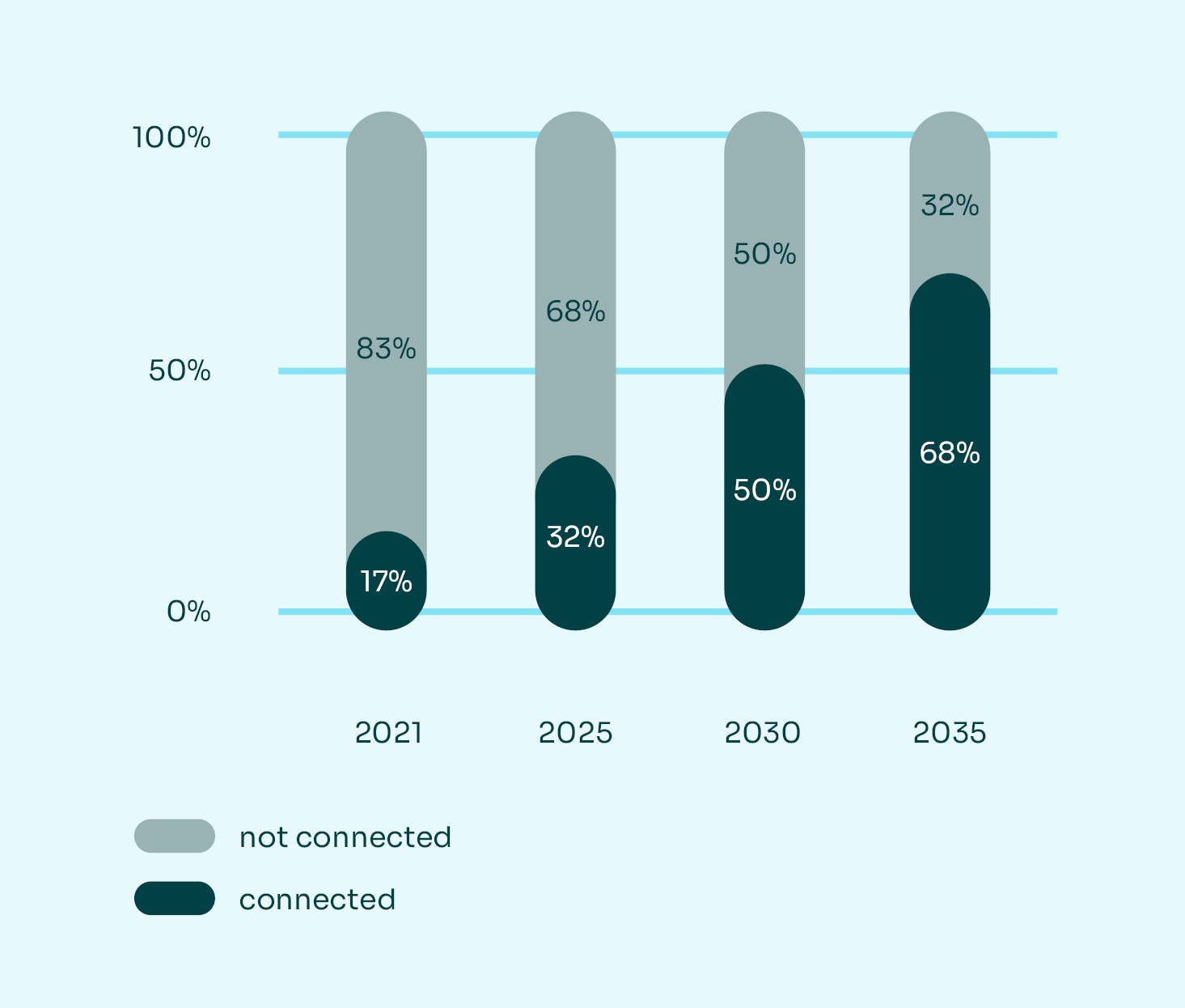

This transformation is reshaping the automotive landscape in profound ways. A major shift from hardware to software driving most vehicle functionalities, as cars increasingly rely on software for differentiation and performance. The growing penetration of advanced capabilities, such as ADAS and autonomous vehicle technologies, highlights the expanding reliance on sophisticated software solutions. Additionally, the rise of connected vehicles—expected to comprise almost 70% of the global car parc by 2035—demonstrates how cars are evolving into “tablets on wheels,” as consumers demand seamless connectivity, intuitive interfaces, and integration with their digital ecosystems.

While it’s difficult to pinpoint an exact value, industry estimates suggest that software can contribute up to 15% of a vehicle’s bill of materials (BOM)—a number expected to grow as SDVs become more prevalent. This underscores the urgent need for procurement strategies that are as sophisticated and adaptable as the technologies they are sourcing.

Connected-vehicle parc will continue to increase

Share of car parc w/ Internet access

*Source: As auto software revs up, suppliers need to switch gears, Nov 2024, BCG Analysis

How Automotive Software Sourcing differs

The transition to Software-Defined Vehicles (SDVs) creates immense opportunities for innovation and value creation. Yet, navigating the complexities of software procurement requires overcoming hurdles that distinguish it from traditional automotive sourcing:

The vehicle software market encompasses various domains such as advanced driver assistance systems (ADAS), infotainment, chassis, body, and powertrain. Procurement teams play a crucial role in sourcing software solutions that integrate seamlessly with vehicle architectures. Selecting suppliers capable of delivering compatible and scalable solutions is paramount.

Stringent automotive safety standards require procurement to prioritize suppliers that can deliver high-quality, compliant software. Ensuring adherence to industry regulations and verifying supplier certifications are critical steps in mitigating risks associated with safety breaches.

As traditional supply chains give way to collaborations with tech giants and startups, procurement teams must adapt to working with non-automotive suppliers. This includes a perceived shift of negotiation power from OEMs to tech suppliers, bridging gaps in expertise, managing differing business practices, and ensuring alignment in innovation, quality, and compliance.

Unlike hardware, software procurement requires a dynamic and iterative approach. Establishing an understanding of software costs, licensing terms, and scalability supported by clear procurement processes and a timeline that accommodates continuous updates and iterations is essential.

A well-defined software BOM is necessary to ensure all software components are accounted for and integrated seamlessly. This includes both onboard and offboard software elements, which must align with the overall vehicle architecture.

Effective software procurement demands collaboration across various functions within the organization, including engineering, procurement, and IT. Aligning these functions ensures that software requirements are well-defined, and procurement strategies are executed efficiently.

Major OEMs like Volkswagen, Daimler, and Toyota are shifting towards in-sourcing selected software development to gain greater control and cost transparency through the breakup of black boxes into the respective hardware and software modules. They are establishing dedicated software divisions, forming partnerships with tech giants like Microsoft and Nvidia, and investing in startups to enhance their software capabilities*.

*Source: Research material_New normal megatrends, technology 2022

Understanding Tech Stack Layers: A Pre-requisite for Software Procurement Excellence

To meet the demands of this software-driven era, procurement teams must adopt a tailored framework that addresses these challenges. It all begins with understanding the Software Ecosystem.

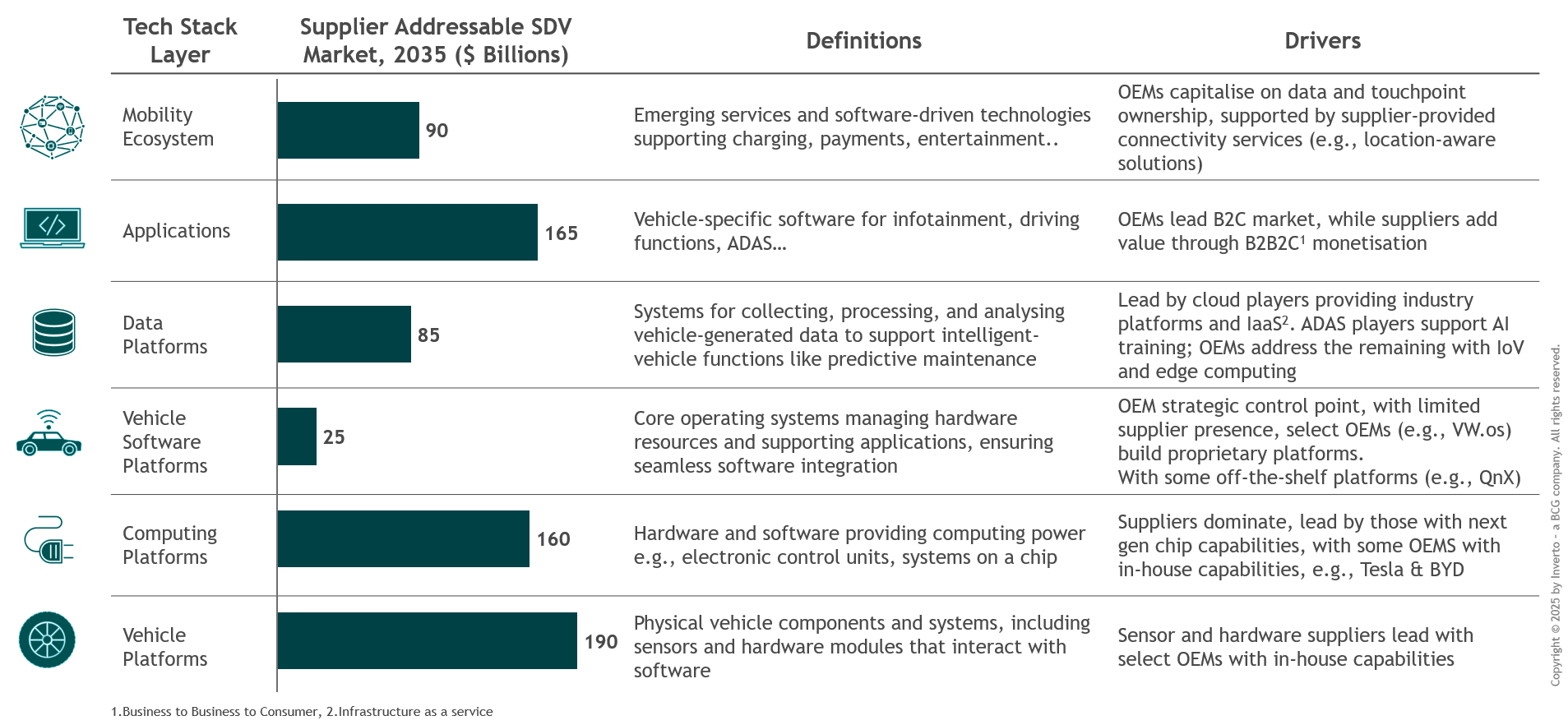

The automotive software stack includes six dimensions:

1. Mobility Ecosystem: Emerging services like charging and e-commerce

2. Applications: Infotainment, energy management, and ADAS

3. Data Platforms: Real-time analytics and predictive maintenance

4. Vehicle Software Platforms: Core operating systems enabling integration

5. Computing Platforms: Systems-on-a-chip powering ADAS and infotainment

6. Vehicle Platforms: Sensors and smart modules

Source: Compare “As auto software revs up, suppliers need to switch gears, Nov 2024, BCG Analysis”

Tailoring Procurement Strategies for Each Tech Stack Layer

For an automotive business to perform successfully, procurement needs tailored approaches for each layer along the following dimensions.

Identifying and managing the right suppliers is critical. This involves rigorous supplier screening, establishing strong relationships, and ensuring suppliers meet the necessary skillset and quality standards. OEMs are looking to suppliers, but of 11 key supplier capabilities, the seven deemed most important by OEMs are the ones where suppliers are falling short. Procurement teams need to be able to assess supplier capabilities and identify those who have potential to bridge the biggest gaps in*:

- Continuously updating solutions

- Software that enables differentiation for OEMs

- High-performing tech (such as AI processing capabilities)

- Cost-efficient solutions

- Plug-and-play solutions, with limited or no integration required

- Highly customizable software that meets OEMs’ specific needs

- Software that is compatible across vehicle models and architectures

*Source: Research material_New normal megatrends, technology 2022

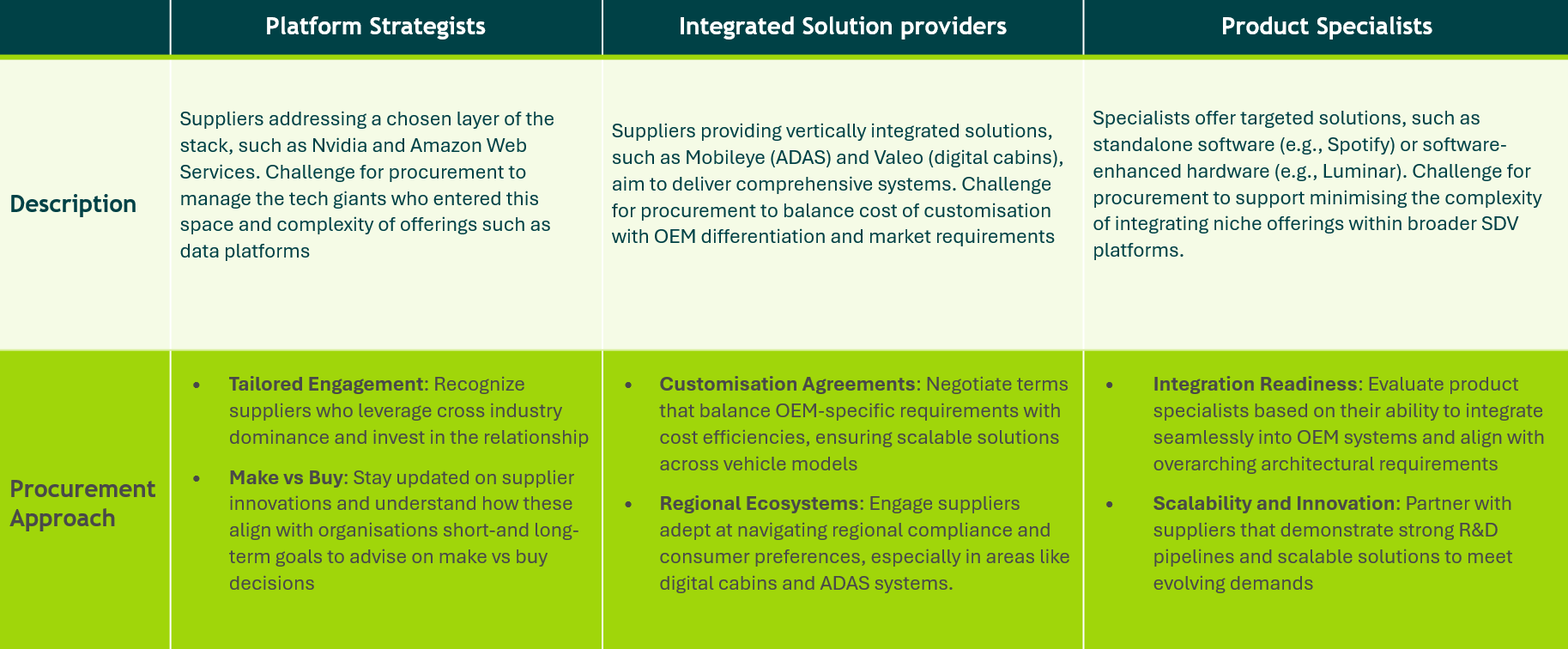

Suppliers are shifting to business models tailored to different layers of the SDV tech stack, disrupting the traditional tiered automotive supply chain. Procurement teams must navigate these evolving competitive dynamics as suppliers adopt three key business models: platform strategists, integrated solution providers, and product specialists. This requires procurement to:

- Understand Supplier Models: Assess suppliers’ business models—whether horizontal platform strategists (focusing on specific layers like data platforms) or vertical (integrated solutions across multiple layers).

- Foster Ecosystem Partnerships: Build alliances that leverage complementary capabilities, filling gaps in expertise and scaling across layers of the stack.

- Decide on Make-or-Buy:

Determining whether to develop software in-house or procure it from external suppliers is a strategic decision that impacts cost, quality, and control over the intellectual property. - Develop Negotiation and Licensing Excellence:

Understanding the true cost of software—including licensing fees and hidden expenses—is critical when evaluating procurement options. Procurement needs to not only understand these costs but also be able to accurately determine them and assess the best contract models, such as licensing versus IP buying. Equally important is the ability to negotiate these agreements effectively to ensure the best possible terms. Negotiating scalable contracts that avoid vendor lock-in and support modular growth is essential. Prioritizing flexibility for recurring revenue models and cross-platform integration ensures businesses remain adaptable and competitive in an evolving market. - Consider Governance and Compliance: Establishing robust sourcing frameworks to manage technical and procurement requirements and ensure all elements of software stack are catered for.

Procurement Approach tailored to the supplier’s business model

4 strong arguments to optimize your automotive software procurement

Optimizing automotive software procurement is crucial for:

![]()

Reducing Costs

Effective procurement strategies can significantly reduce costs associated with software development and licensing.

![]()

Enhancing Quality

Ensuring high-quality software integration that meets all industry standards and enhances vehicle performance.

![]()

Accelerating Time-to-Market

Streamlined procurement processes can reduce lead times and accelerate the development and launch of new vehicle models.

![]()

Improving Supplier Relationships

Strong relationships with suppliers can lead to better terms, enhanced collaboration, and innovation.

What is your Maturity Level in Software Procurement?

Automotive OEMs and Tier1/2s should ask themselves six crucial questions to become aware of their software purchasing capabilities.

How we can support you

We support you across the entire software procurement journey:

- Assess maturity: We evaluate your current procurement setup, identifying strengths and areas for development, including technical and organizational interfaces.

- Design TOM: We define a tailored Target Operating Model (TOM), incorporating buyer roles, required skills, and organizational structure for software excellence.

- Strengthen negotiation: We help shape a winning negotiation strategy, support make-or-buy decisions, and guide you through tender execution.

- Build strategy & capabilities: We develop a long-term software sourcing strategy, create a knowledge database, and define supplier & partnership strategies aligned to your position and sector.

Acknowledgement

Special thanks to Jennifer Herman for her valuable contributions to the development of this article.