Private equity firms have literally applied all levers on the top and bottom line in order to beat the pandemic and stabilize margins. Closer inspection reveals, however, that procurement still has a long way to go to exploit the full potential.

So far, private equity firms and their portfolio companies have largely emerged from the coronavirus pandemic relatively unscathed. Although 80% of the experts who responded to our survey reported declining sales in their portfolio companies, these have only caused a fall in profits for around half the respondents (55%). Compared to the pre-pandemic situation, private equity firms are clearly operating more defensively. Respondents in our 2019 private equity survey put the focus squarely on implementing top-line measures to boost the value of their portfolio companies.

Expansion and add-on acquisitions – top-line measures that dominated the 2019 survey along with sales investments – have become significantly less popular in the latest study, however, with the focus shifting to the bottom line.

This is astonishing, given that 76% of respondents are currently seeing their investment opportunities either rising or staying the same, while 82% are noticing investment prices falling or remaining unchanged. These figures could be interpreted as a sign that the climate for acquisitions is positive: since there is still dry powder stored in the arsenals, we are now seeing a renewed willingness to invest.

Portfolios Less Dependent on Economic Developments but More Sustainable

At the same time, private equity firms have increasingly shifted their focus to industries including professional services and pharma/healthcare – and both of these areas are less dependent on the economy than manufacturing industries, for example. Although industrial goods are still in the top three investment targets, they have fallen sharply to 37% compared with the 2019 survey, where they accounted for more than 50% of all investments.

ESG (environmental, social, governance) criteria have also retained their importance, with 55% of respondents saying that sustainability criteria play an important role in investment decisions and that this has not been affected by the pandemic either. Just 9% of survey respondents report that the issue has become less of a priority due to coronavirus.

Bottom Line Gains Importance

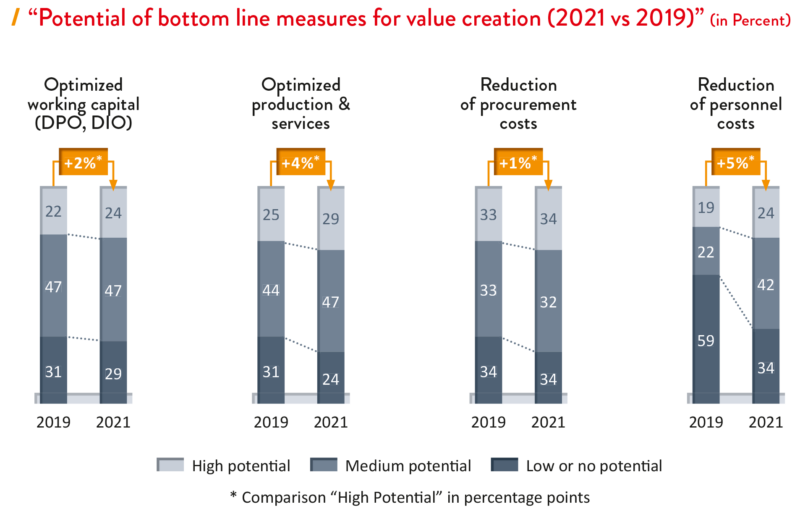

After more than a year of pandemic, it is clear that all the companies that responded to the survey have intensified their efforts on the bottom line and that all areas are consistently seeing greater potential for creating value than two years ago.

This is no surprise, given that top-line operations are usually linked to investments, while the fields of action on the bottom line involve savings, cost reductions and stabilizing cashflow. In other words, these measures have an immediate effect and mostly do not require initial investments. As the pandemic forced many companies to restrict business operations or even close completely –

unlike the usual economic crises – it is understandable that reducing staff costs became more important. But we believe that, in many cases, this more likely involves reducing working hours, rather than laying staff off and, we expect to see the skills shortage, once again, becoming the main staffing issue when the pandemic is under control.

Standard Strategies Widely Used, More Sophisticated Concepts Less Common

On taking a closer look, it was clear that portfolio companies in procurement are implementing measures that promise to deliver a rapid improvement in results: bundling, renegotiations, tenders, and so on. This is where private equity firms can also operate across companies, pooling suppliers for all their portfolio companies, for example, or bundling requirements for several companies in their portfolio.

While these measures are necessary and effective, and they achieve quick results, they only offer limited leverage. If companies want to exploit the full potential for cost reductions, they should also utilize more sophisticated concepts such as demand management – conducting a precise analysis of all requirements – or technical respecification – such as looking for substitutes for raw materials. Private equity firms are perfectly aware that they could do more in this area. When it comes to sophisticated levers, 43% of survey respondents are aware of potential that is still untapped.

In the area of procurement digitalization, just over half (51%) of respondents report missed opportunities. Admittedly, selecting and implementing digital solutions requires investment, so it is understandable that resources are not available if the pandemic has disrupted sales. Put simply, however, digital projects offer a fast and measurable return on investment, so private equity firms should definitely push for this in procurement projects.

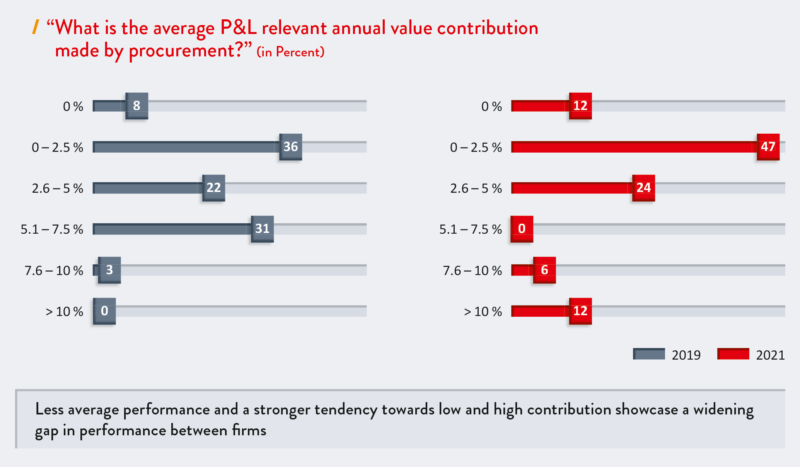

Good Procuement Organizations Make For Significant Value Creation

The value that is delivered by procurement departments in portfolio companies varies greatly; in almost 75% of companies it is up to just 5% per year. Even so, 18% of respondents are achieving a value contribution of over 7.5%.

These differences are also clearly visible in exits after five years on average. While the majority reports an overall contribution of up to 10% by procurement, the best procurement teams achieve value contributions of over 25%.

The discrepancies can fundamentally be linked to three criteria. The biggest value contribution through procurement was achieved by private equity firms that:

Set clear goals

Of the companies with above-average success, 67% of the private equity firms set clear procurement goals, compared to just 33% of the firms with a value contribution of less than 2.5%.

Use all the standard levers at their disposal

89%

Bring in external consultants

Of all survey respondents, 54% reported that they involve external consultants in procurement for their portfolio companies. The top reasons given for this strategy are the need for an objective perspective (52%), a lack of skills and specialist knowledge within the company (48%) and lack of staff (41%). Generally speaking, the companies that rely on the expertise of consultants perform better than those that do not.

Download the full White Paper, including detailed recommendations for action, free of charge here:

About the Authors:

Jens Kiebler:

Jens Kiebler is a Principal at INVERTO in Cologne. He is an expert in restructuring procurement organizations and optimizing working capital. He mainly advises customers from process manufacturing, machine and plant engineering, as well as private equity firms.

Torben Menzel:

Torben Menzel is a Project Manager at INVERTO in Cologne. He mainly manages projects in the industrial goods and process industries, and also supports the Competence Center for Principal Investors & Private Equity.