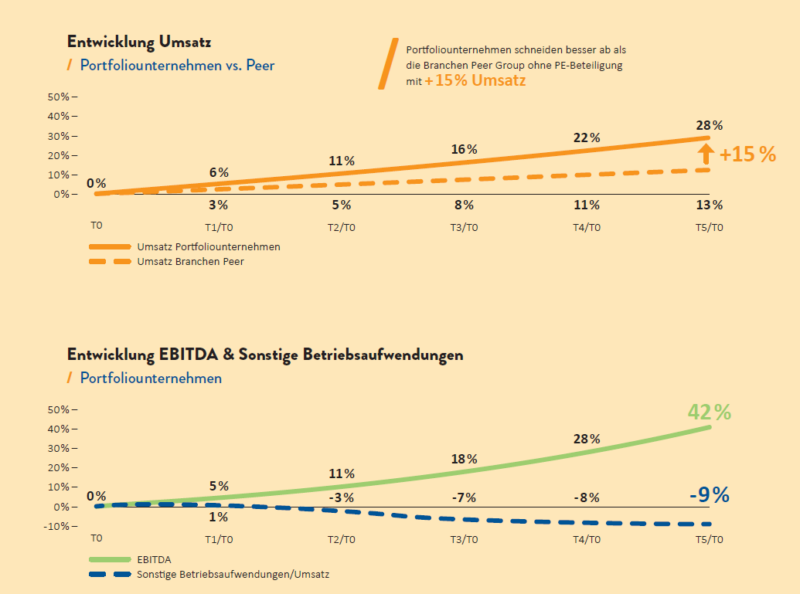

Portfolio-Unternehmen erfuhren in den ersten fünf Jahren nach dem Erwerb eine signifikante Wertsteigerung.

Unsere Langfrist-Analyse zeigt für die betrachteten Branchen Industriegüter und Prozessindustrie, dass Misstrauen gegenüber Private Equity Gesellschaften weitgehend unbegründet ist. Wie unsere Zahlen zeigen, handeln viele Private Equities eher langfristig und sind an nachhaltigem Geschäftserfolg orientiert. Durch die Herausforderungen der Corona-Pandemie sind Unternehmen in Schieflage geraten und daher auf der Suche nach Kapitalgebern. Zeitgleich stehen Private Equity Unternehmen hohe Kapitalsummen zur Verfügung („Dry Powder“). So ergeben sich vielversprechende Möglichkeiten für beide Seiten.