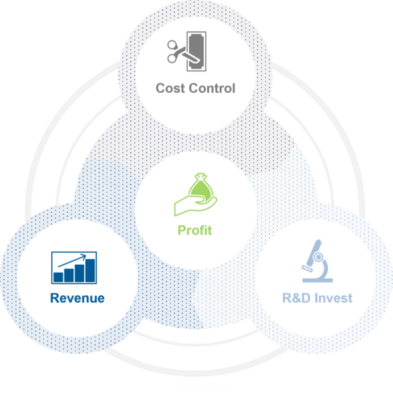

Research and development is surely one of the distinct KPIs to drive revenues through competitiveness and eventually to generate profit, which ensures long-term success of the company. In order to free up funds for research and development there are essentially two options, either increasing revenues or reducing cost.

Research and development is surely one of the distinct KPIs to drive revenues through competitiveness and eventually to generate profit, which ensures long-term success of the company. In order to free up funds for research and development there are essentially two options, either increasing revenues or reducing cost.

Boosting profitability by focusing on cost savings is a very effective strategy. By implementing cost-saving measures, MedTech companies can optimize their operations, streamline processes, and enhance their overall financial performance. Furthermore, improving cost has specific benefits such as:

- Achieves in general fast results and requires less investment compared to e.g., improving revenues

- Is sustainable and can last over a long period when done correctly e.g., by fixing terms with suppliers over a longer time period